In January 2024, Bitcoin Policy UK wrote to Bim Afolami, the then City Minister, following a deep dive into the exchange traded products offered by the UK firm Jacobi Asset Management – highlighting the sad fact that these could not be offered to UK retail investors.

On 12 September, we wrote another open letter to the new City Minister, Tulip Siddiq MP (copied to the Chief Executive of the FCA).

In or letter, we highlight the wide gulf opening between the US regulated market in Bitcoin and the UK’s; we flag the absurdity in the FCA forbidding citizens from buying regulated products tracking Bitcoin, yet allowing them to buy Bitcoin the asset itself; and emphasise the risks to the UK’s reputation for financial innovation and, frankly, competence in financial services, as a result of the FCA’s current policy position.

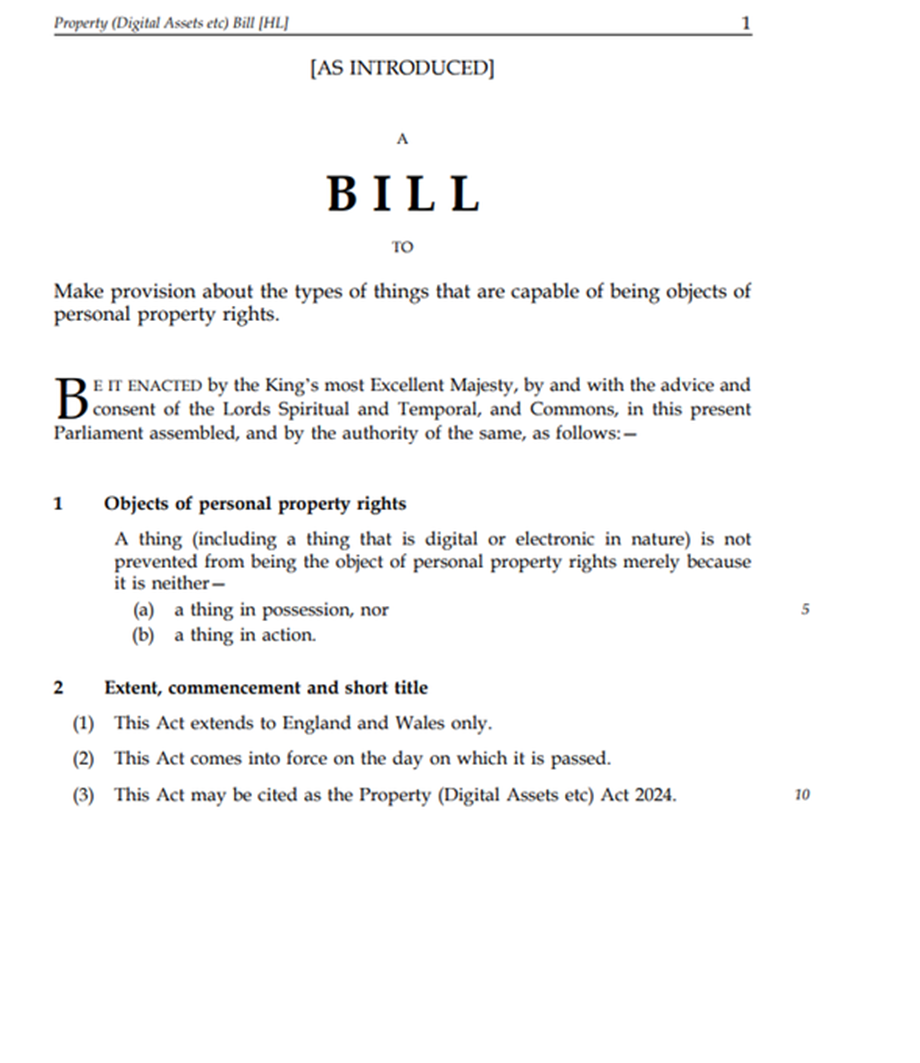

Coming hot on the heels of the newly proposed legislation that would formalise Bitcoin as a new kind of property, the FCA’s position looks increasingly untenable and is in danger of rendering the UK as little more than a financial services backwater.

This must change.