The UK is now a leader in fighting Bitcoin

A guest post, by Bitcoms (with thanks from BPUK)

It’s becoming increasingly difficult to be a Bitcoiner in Britain. Many UK retail banks now routinely restrict capital from flowing to the exchanges where most people access Bitcoin. Rolling 30-day limits on amounts customers can send to exchanges have been applied by many banks such as HSBC (£10k), RBS and NatWest (£5k), and Santander (£3k). Several banks such as Starling block exchanges altogether. At the time of writing, it would take a Santander customer a year and a half to acquire a whole bitcoin, and a Starling customer until the end of time. Whatever the intention, it’s hard to see such outcomes as consumer protection.

Central Bank in Madeira (amusingly, closed for repairs)

Even if you manage to get your hard-earned fiat to an exchange, further obstacles await. Like many other countries, the UK authorities oblige customers to satisfy know your customer (KYC) and anti-money laundering (AML) requirements. But mandatory ‘client categorisation’ and ‘appropriateness assessment’ questionnaires introduced by the Financial Conduct Authority this year likely mean many UK-based Bitcoiners will be disqualified as ‘investors’. It’s difficult to see such frictions as demonstrating anything but the UK’s hostility to Bitcoin.

But how does the UK compare with elsewhere? Is it just part of an international trend to stifle Bitcoin, or is it an outlier? To get a sense, we’ve asked around, including interviewing attendees and speakers at Bitcoin Atlantis, a new international Bitcoin conference in the mid Atlantic.

Regulatory Frictions

Because British Bitcoin exchange Coincorner’s services are available in around 40 countries, CEO Danny Scott has a broad international overview. “Honestly, standard KYC/AML rules are the main barrier to entry, but nothing more than you would expect opening a bank account on this front for most countries,” he says. “The UK is currently the only one that requires additional things such as the financial promotions quiz, which can become a further barrier to entry.”

Sam Wouters heads up marketing and content at US Bitcoin-only financial institution River, but is himself based in The Netherlands. He confirms Danny Scott’s assessment. “From the Netherlands perspective, it’s not too difficult there, and for the most part you can get access to Bitcoin relatively easily assuming you can verify yourself by doing the KYC (which is going to be the case almost everywhere). I have noticed in the UK.. things are getting much stricter, where people need to go through a series of questions to be able to show that they are a kind of an accredited investor. People can buy so much nonsense, they’re allowed to go gamble with all their money, but if they want to buy a bit of cryptocurrency or Bitcoin, then suddenly you need to be some genius investor, and that’s where things get a little bit silly.”

As an Australian podcaster and educator based in the UAE who works with Swan Bitcoin in the US, Stefan Livera has an international perspective. He thinks the FCA questionnaires may be unprecedented. “I’m seeing people [in the UK] saying “look at all these questions they’re asking me before I can even buy Bitcoin”. I genuinely haven’t seen that in other countries. It seems that the UK is one of the worst in terms of… government regulations that are overbearing.”

Around the world, the story is similar. Jesse Wales, a Bitcoiner from Australia, confirms that “there’s no questionnaire like you guys have in the UK yet.” Javier Bastardo, the Latin America ambassador for Bitfinex, explains that across the region there is little friction. “Right now it’s not like it’s hard to get Bitcoin or to register on a platform, it’s really super easy,” he says.

But the unusually high regulatory barriers erected by the UK are not limited to questionnaires. “We’ve actually stopped doing business in the UK, but in all the EU countries we still accept users,” says Julian Liniger, CEO of buy and sell Bitcoin-only app Relai. “In 2023, we stopped. Just listening to our lawyers, the UK is really getting more and more strict: there’s a lot of things you need to do, a lot of data you need to collect, and huge fines if you don’t comply. But it’s not clear how exactly we could comply, or even whether we need a local licence with the regulators in the UK itself or not.” So while Relai can confidently navigate the European legal labyrinth and be comfortable its operating framework is compliant there, the lack of regulatory clarity in Britain means doing business here is untenable. “So we took a risk-off approach and just left the UK.”

Banking Frictions

Liniger also explains how banks across Europe interact with Relai. “You see that definitely some banks are less co-operative and more anti-Bitcoin, so they make it hard for people to send money to a Bitcoin exchange like us,” he says. But other banks are fine. “For example in Germany many banks are great to work with,” he explains. “Usually the more traditional banks like Sparkasse, for example, or Volksbanken… can make it harder, but there’s no real pattern in terms of countries.”

This mixed national banking picture is common to many countries. “It depends on the bank. Some of the big banks, like Commonwealth Bank, they cause a lot of friction. But then there are some small ones (which are easier)”, says Jesse Wales of Australia. Canada is a similar story. “Canadian banks have not been very friendly to Bitcoin historically”, says Ben ‘BTC Sessions’ Perrin, a Calgary-based Bitcoin educator. But it often doesn’t seem to be a matter of explicit policy as such, and treatment by individual banks is inconsistent and unpredictable. “It’s mostly just kind of however the institutions feel. That’s how it comes across.”

Slightly different but equally inconsistent banking treatments are cited by Yuliy Yiliev, Bitcoin Business Executive at Bulgarian football club Botev Plovdiva. “When you try to send funds from your personal bank account to an exchange, you usually get the transfer blocked and the funds back in your bank account,” he says, but by contrast “there are no restrictions at the moment with a credit or debit card.” Again, there don’t seem to be explicit policies or regulations. “You don’t have a regulator saying the banks cannot send funds to exchanges,” he explains, “this is something which is decided internally in the bank.”

It’s worth remembering, though, that these banking frictions are not necessarily malicious in any country, including Britain. “I don’t believe banks limiting how much money you can send to exchanges is due to “Bitcoin” itself,” says Danny Scott. “It’s more related to a new consumer protection law soon coming in for UK banks which will make the bank liable for a percentage of the amount sent if the customer ends up a victim of fraud or a scam. Rather than put processes in place to make sure the customer is not being scammed, it’s quicker and easier for the banks to just limit sending to some industries.” Regulations, actual and promised, can sound positive in theory, but often have unintended negative consequences.

Portugal, and specifically Madeira, has historically had a far more enlightened approach to Bitcoin than has the UK.

The Big Picture

Zooming out globally, Samson Mow, CEO of Bitcoin-focused company Jan3, has a different take. “I think Western countries are going to tighten up because they want to control the money and control the population,” he says. “It’s all about protectionism, closing borders, in this case closing monetary borders. They don’t want money to leave. But that is not a solution because money is now information, because Bitcoin is information. So money will flow. I think it’s important for countries to understand that you can no longer control the money.” Nonetheless, Mow sees an opportunity for Britain. “I think there will be outliers, early adopters amongst the western countries. I hope that the UK can be a forerunner in this because they’re not a part of the EU,” he says. “The next logical step is to embrace the world’s money, which is Bitcoin.”

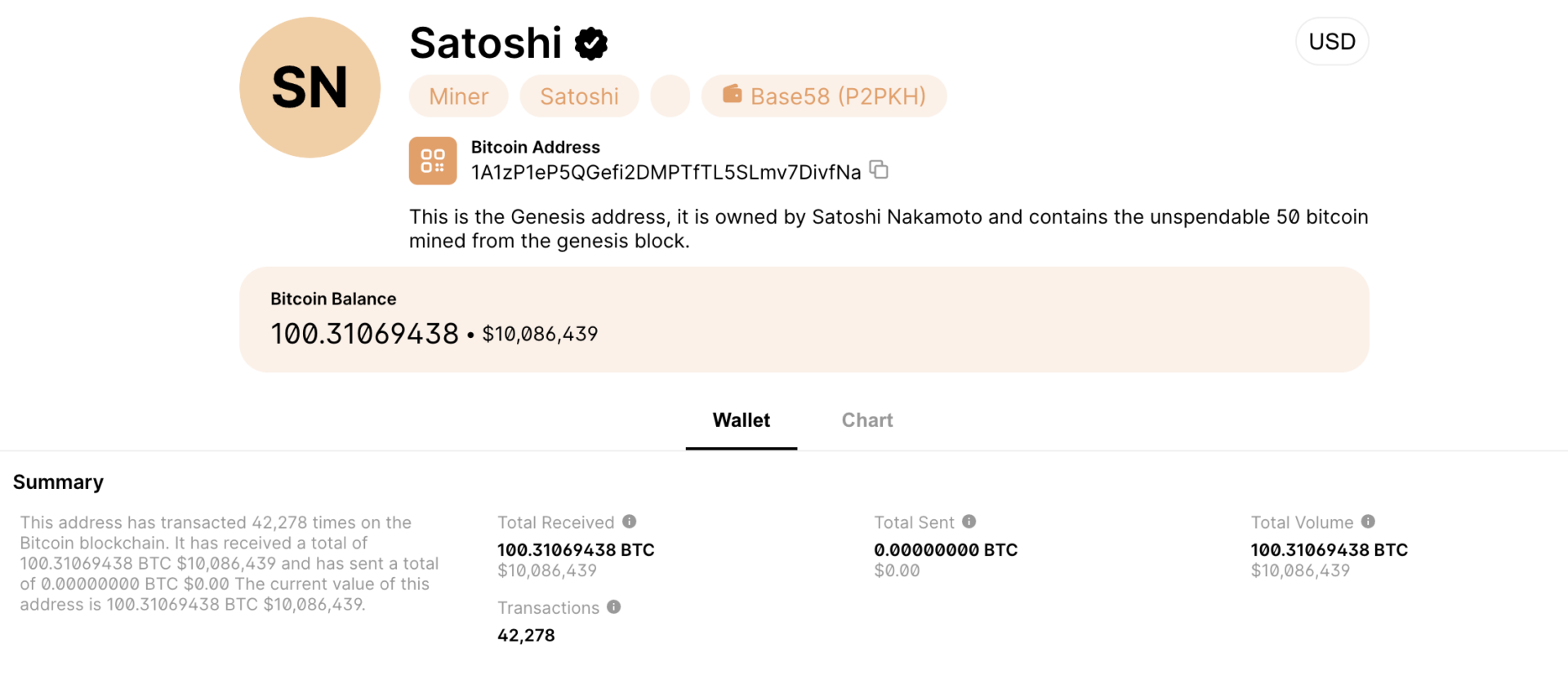

Whether the UK’s formidable frictions against it are deliberate or unintended, Mow’s belief that Bitcoin is unstoppable is echoed by globetrotting Bitcoin journalist Joe Hall. “No matter how hard you restrict it, it’s still going to find a way through,” he says. “It’s like this weed that you just can’t get rid of in your garden. It’s just going to keep shooting through.”

“Symphonia Coloris” – Credit to Catherine Aronson

Anti-Bitcoin Britain?

Whether or not Bitcoin is an irresistible force, Britain seems to be trying harder than other countries to block it. While UK banks are not unique in hampering access to Bitcoin, by international standards many seem unusually draconian in having monthly limits or blanket bans as stated policies. Implicit regulatory concerns may lurk at the root of these measures.

But it is with explicit regulation where the UK has truly become a global leader in resisting Bitcoin. Not only do its new exclusionary questionnaires seem without rival internationally, but its regulatory environment is so hostile that reputable Bitcoin businesses operating with confidence in comparable countries are unable to do business here.

Whether all this is an unforeseen consequence of well-intentioned regulation or something more deliberate, the UK is moving ever further away from being a leading ‘crypto hub’. By accident or design, it has instead become the very opposite: anti-Bitcoin Britain.

By Bitcoms

Follow Bitcoms